Solving the Three-Body Problem in Banking

The “Three-Body Problem,” currently made popular by our new favorite author, Cixin Liu, is the concept of instability when three similar-sized celestial objects interact. The problem is currently unsolvable. Banking has a similar physics problem when management juggles strategy, risk/profitability, and customer behavior. This article will discuss the challenge of managing three potentially opposing forces and look towards physics to help us solve the mystery.

The Three-Body Problem Explained

When two bodies of similar mass interact, such as our Earth and Sun, they do so on a single plane in two dimensions. The consistent interaction, such as the gravitational pull, creates inherent stability in the system. Almost of equal importance, the 12 variables used to determine the position of each body can be reduced to a general formula so that you can predict where each body will be at any given time. The problem is stochastic in nature, so probabilities can be used to estimate any randomness, such as what might happen if our Sun increases its mass.

When a third body is introduced into the system, all heck breaks loose. Randomness takes over, and the system becomes chaotic. The three bodies lack stability, there are 18 variables, and our mathematical tools of algebra and calculus cease to be much use. Positions, velocities, and gravitational forces cannot be predicted, and often, bodies fly off into space out of the system or collide. Euler, Pythagoras, Newton, Fermi, Einstein, Hawking, and many others of humanity’s best minds have failed to figure out the mind-twister.

Fortunately, banking is easier.

The Three-Body Problem in Banking

If you have two forces, such as profit maximization and customer experience, you can optimize the solution to any point a bank desires. For example, when pricing certificates of deposit, a bank can look at the historic elasticities of demand and set the price to capture the appropriate required volume (below). Here, customer behavior is known, monitored, and managed. As a bank changes its offered CD rate, it can observe volume changes and better understand customer behavior.

Sometimes, when a bank pays a higher rate for its CDs, it attracts new customers with an unknown behavior profile. While banks understand that a higher cost of funds results in lower profitability, most banks fail to appreciate the added risk they are taking by onboarding not just a more rate-sensitive customer but a rate-sensitive customer with an unknown behavior profile.

When you introduce some aspects of strategy, risk-adjusted profitability and customer behavior start to get unstable and almost impossible to predict in a generalized formula. A bank can model risk-adjusted profitability as it pertains to a change in price. Still, it can’t accurately calculate risk-adjusted profitability as it just took on a set of customers with higher but unknown interest rates, liquidity, and brand sensitivities.

In our deposit example above, attracting new deposits from existing customers is one thing, but when a bank needs new customers to grow, it takes on a certain amount of unknown risk. Like planets and stars revolving around each other, most of the time, this is fine. Three celestial bodies can spend thousands of years in various, unpredictable orbits only to one day align in a certain way to create terminal stress.

Entering a Chaotic Period

Silicon Valley Bank, First Republic, and Signature Bank are just the latest examples in our industry. Things were fine until they were not. In each case, the respective growth strategy at each bank sowed unseen risk. In each case, the banks attracted customers who were concentrated and interconnected. In each case, the bank’s risk surface changed, traditional risk models failed to capture the risk, and the customer behavior caused liquidity stress to spin out of control. Customers reached a tolerance point and then fled. Interest rate risk turned into liquidity risk, and each bank ended up failing. In our industry, we model risk in silos, and this is what our industry gets.

In the past, growth strategies in credit risk have turned into liquidity risk and have caused the bulk of our industry’s failures. Next to credit, growth strategies have also impacted compliance, controls, and governance. Often, a bank that is growing faster than the economy will do so by taking on riskier customers or will create risk faster than the risk management process can manage. The result is the bank becomes unstable.

Sometimes, strategies around efficiency cause the combination of growth, risk management, and the customer experience to become unstable. Cost cutting at banks often increases risk in unseen ways. Technology platforms don’t keep pace with the customer experience or risk management, and chaos ensues once an extraneous shock hits.

Luckily, a bank is more manageable than a universe.

Solving the Three-Body Problem in Banking

One solution is to have better multi-disciplinary risk models so that the risk surfaces of banks can be better understood. When we say that the three-body problem is unsolvable, we mean that it cannot be solved in a generalized way with a set of formulas. While we can no longer know the exact risk of new products, customers, or markets, we can still get a general understanding.

The problem is that most banks don’t have the tools to quantify this added risk. Most risk models at banks qualify if the risk is higher or lower compared to the bank’s present state given the new initiative. Banks often stop short of estimating the degree to which this risk changes.

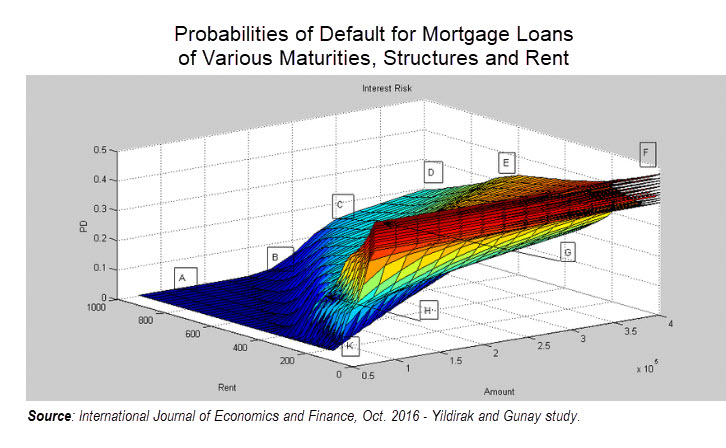

Having higher compute power, such as those available in a quantum computer, will help banks get more exact in this additional risk quantification. Right now, the limits of our computational ability are approached by mapping the risk service of a single product such as mortgages (below). Being able to map the risk surface of customer behavior, market pricing, liquidity, credit, and interest rate movement for a set of products or for the entire bank could go far in understanding the impact of multiple risk influences. Unfortunately, we are still a few years off from this computational power.

A more obtainable solution is to manage the elements of the problem better. While you can’t control the mass of objects rotating around each other, banks can control the size and type of growth, and customer behavior. The critical point here is to execute strategies in more predictable ways.

While bank management may not be able to predict the combination of customer behavior, interest rate risk, and liquidity, it is not farfetched to understand that risks are related. Taking on customer growth in venture capital, high-net-worth, or crypto deposits could be impacted by interest rate risk. Credit risk can, and likely will, also result in liquidity risk during the next recession.

Reviewing Strategies for Quality

Strategic initiatives in banking need to be assessed through a quality lens. Not all growth or cost-cutting is good. Growth in customers, credit, and deposits all come in varying degrees of quality. Some customers, for example, are more inherently stable. Single-product customers, for example, are more unstable than true relationship-driven customers. Variable-rate loan customers are more unstable than long-term fixed-rate loan customers.

While some customer types are unstable, some bank products are unstable as well – customers of CDs, construction lending, and third-party banking-as-a-service customers all have higher-than-average volatility in their customer behavior.

Readers of this blog know this is one reason why we love general corporate treasury management and payment customers. The customer types attracted to these respective products tend to have well-understood customer behavior.

It is important to have experience and an understanding of the composition of your customer segments and their corresponding behaviors. New customers and new customer segments can make a bank unstable if not managed correctly. Banks taking on lower-quality growth need to offset the risk with lower interest rates, credit, and liquidity risks.

Putting This into Action

Solving the three-body problem in banking is more of a thought experiment than practical advice. Unlike most of our articles, there is no executable solution here. We raise these concepts only to think about old problems in a new light. Bank management should understand the blind spot of not being able to understand the true risk surface of the bank and how strategic elements such as growth and efficiency can have difficult-to-see influences on risk-adjusted profitability and customer behavior.