5 Campaigns to Increase Deposits Targeting Digital Wallets

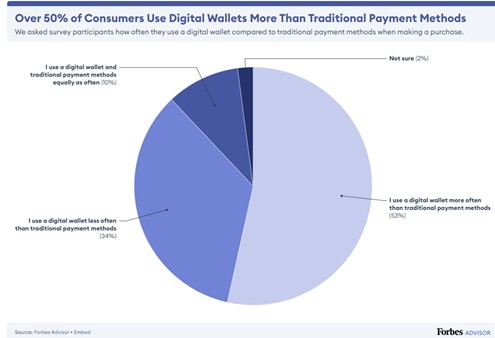

Bankers often overlook how much money is stored in digital wallets away from their bank. While the amounts are relatively small on an individual basis, they are massive in aggregate. While some of these are stored at the banking-as-a-service banks such as Goldman Sachs, or The Bancorp, many digital wallets, like Starbucks, reside at the corporate level without interest or insurance. In this article, we highlight the details of these digital wallets and provide bankers with five marketing campaigns to bring these deposits back on balance sheet.

According to a recent Capital One study done at the start of this year, 65% of U.S. adults said they used a digital wallet at least once in the past year. In 2023, the global value of these digital wallets was approximately $9T. PayPal, Venmo, Apple Pay, Google Wallet, Samsung Pay, Starbucks, Cash App, Dwolla, and many others each have value banks can bring back. Below is a sampling of the average balances we calculated.

The Potential Of Digital Wallet Targeting

More than a majority of bank customers maintain balances in three or more digital wallets. For example, if a bank customer has balances in each of the wallets in the graphic above (common), that is a potential $1,990 of balances your bank could use per customer. That is almost $200 million of potential new deposits for every 100,000 customers. Banks should aim to bring back 10% to 25% of these funds, which equates to between $20 million and $50 million in deposits per 100,000 retail and small business customers.

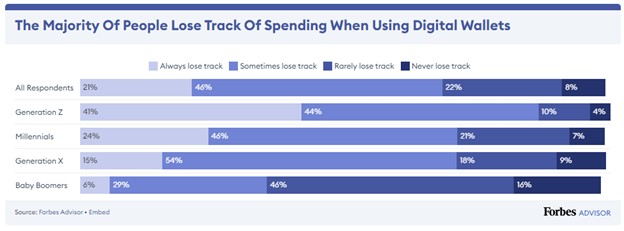

The Psychological Factors of the Digital Wallet

One critical element based on economic behavior science is that customers prefer to keep track of their money. The reality is that bank customers clearly understand their balances, fees, and terms from their bank, but most bank customers lose track of their digital wallet funds. This fact can create a question about these balances and enough anxiety to move these customers to action. A recent Forbes Advisor study showed that 67% of all digital wallet holders either “always” lose track of their wallets or “sometimes” lose track. For the Gen Z cohort, this number rockets to 85% (below).

Tactic 1: The Crypto Play

As the holders of the now defunct FTX wallets , and the Sam Bankman-Fried saga can tell you, the crypto realm is murky and rife with risk. While reputable crypto wallets segregate funds, some lesser-known exchanges have been known to comingle money, putting every customer at risk. Moreover, crypto wallets have some of the most significant balances, so banks can succeed by suggesting that a portion of the money should return to banking. Coinbase, Ledger, SafePal, eToro, TrustWallet, Exodus, KeepKey, and MetaMask hold over $5B by our estimates. While much of these funds are in crypto, some remain in U.S. dollars or in crypto that the user would be interested in converting back.

When crypto prices are up, more users are willing to undervalue and overlook the risk. However, when crypto prices fall, crypto holders are more open to returning these funds to U.S. dollars and returning them to a bank. Banks should have campaigns ready to go and then launch an email campaign marketing the bank’s safety, soundness, control, and liquidity. Get the timing right, and banks will see funds come back on the balance sheet.

Tactic 2: Teach Users How to Transfer Funds from Their Digital Wallet

The most significant impediment to transferring funds from a digital wallet to a bank account is that most digital wallet holders don’t take the time to understand the process. A bank that provides a step-by-step guide and perhaps a video on moving money from Venmo or PayPal should find balances coming back.

Tactic 3: Provide Digital Wallet Users with the Routing Number

The second biggest hurdle to transferring funds from a digital wallet to a bank account is the fact that digital wallet users don’t know where to easily find a bank’s routing number and their own account number. Most users of digital wallets do so because it is easy and transferring money is as easy as searching a phone number in contacts or taking a picture of a QR code. Easily provide the routing and account numbers, and money will flow back.

Tactic 4: The Safety, Soundness, and Control Play for Excess Balances

PayPal is the most common wallet with balances. The average PayPal user has almost $500 in their wallet, more than the $196 of U.S. currency that the average bank customer over 30 carries around in their physical wallet. Likely, the customer with those balances doesn’t need that level of liquidity. Banks should consider a marketing campaign reminding customers to keep the minimum amount of funds in their wallets to handle weekly transactions. Excess funds should be brought back to the bank for safety and soundness reasons, let alone to get the peace of mind of having funds all in one place.

FDIC insurance doesn’t matter until it matters, and the funds in many digital wallets are not insured. Similarly, many digital wallet users have funds from single-use events in apps like Cash App, Starbucks, or Walmart Wallet. Many of these accounts are dormant and forgotten about. Reminding users to consolidate their balances of little-used apps will resonate with most customers.

Some of these apps, such as PayPal and Venmo, have a large number of small businesses on them. PayPal, for example, has 36 million small businesses with accounts. Many of these account holders would be open to hearing about what banks can do for them regarding treasury management and payments.

Tactic 5: Fees & Interest on Their Funds

While we never like marketing on interest rates, this could be one exception. Reminding digital wallet users that they are likely not getting paid on their balances at Starbucks, Venmo, PayPal, or others is a way to incentivize customers to move money back to the bank financially. In fact, a bank can set up a single promotion to pay an above-average rate that makes sense solely targeted at new money from these digital apps.

If you are as reluctant to remind customers about rates, the other sub-tactic here is to remind customers of the higher fees and the delay in moving money from these digital wallet apps. These fees range from 0.5% to 2.9% to move money.

For example, if you have to move money without a fee through PayPal, it will take 3-5 days to effect a complete ACH transaction. If you want to get your $500 balance back instantly, PayPal will charge 1.75% or $8.75 to move the money via a real-time payment or debit card, taking 30 minutes. That same transfer would likely take a bank 15 seconds to move at a charge of about $0.50.

Putting This Into Action

Building deposits can happen in many different ways. Sometimes banks need to take advantage of broad, sweeping movements such as the Investing in America Programs that we highlighted HERE. Other times, deposit building demands being micro-focused on specific tactics such as moving funds from digital wallets.

Payments at many of these digital wallets have grown at a 20% annualized rate over the past five years, and balances have continued to increase. Companies like PayPal and Starbucks have billions of dollars of customer funds sitting in non-interest-bearing, non-FDIC-insured accounts. Some of this money should return to banks as deposits and are there for the asking. Banks must target a message, teach customers how to send money into their bank account, and then ask for the business. Banks that do can not only build deposit balances but can use marketing to better inform customers of their cash management and payment capabilities. The result should be a higher balance and higher future engagement.