8 Lessons From The Jamie Dimon Shareholder Letter

Robert Wilmers, the CEO of M&T, used to write one of the best bank investor letters. With Mr. Wilmers retired, we are down to two “must read” letters: Berkshire Hathaway’s and JP Morgan Chase’s (JPM). We feel that as community bankers, we can learn from Jamie Dimon (Chairman and CEO of JPM) and from Warren Buffet’s annual shareholder letters. Last week, JPM released its 84-page 2023 shareholder letter and 364-page annual report. As usual, it was full of insight that every community banker should consider. We do not opine or care so much about JPM-specific performance and leave that to the equity analysts. Our focus is on information that pertains to the community banking industry.

Lesson 1 from Jamie Dimon: Inflation May be Stickier Than Anticipated

The letter had 31 mentions of inflation and inflationary pressures. Jamie Dimon (Jamie) believes that the economy is being fueled by large amounts of government deficit spending and previous stimulus. This may lead to stickier inflation and higher interest rates versus market expectations. World-wide remilitarization, reduced globalization, the transition to green economy may also act to keep inflation higher than the market expects. He also stated that the Fed’s move from quantitative easing to quantitative tightening will trigger a significant change in the flow of funds, which drain liquidity from banks. Liquidity reduction on this scale is unprecedented.

Lesson 2: Leadership Matters

Jamie Dimon cites military decision making referring to the term OODA loop (observe, orient, decide, act) that we have written about HERE. There are a few important tidbits we found compelling.

- Bank leaders must obtain knowledge in person. Road trips, client meetings, briefings, and visits to call centers, branches, and regulators allow leaders to observe and assess the bank and the market.

- Bankers sometimes develop beliefs that are very hard to dislodge but they may be wrong. Jamie urges bankers to shed sacred cows, seek out blind spots, and challenge the status quo.

- Use data, analysis, and decision making to figure out the truth, and not to justify existing thinking.

- Leaders must try to discern long-term trends. This is very difficult to do, as all too often emphasis is on short-term (monthly) data. He underscores how fiscal spending, the need to spend on green technology, remilitarization of the world, and the restructuring of global trade are all inflationary.

- Leaders develop a decision-making process. This involves creating a step-by-step guide that involves time frames, consultation, information sharing, and debate.

- Jamie states that the secret sauce to leadership is to “have a heart.” He means that leaders earn trust every day, and people need to be convinced that a leader does not have ulterior motives, but instead wants to do the right thing for the organization, employees, customers, shareholders, and the communities the banker serves.

Lesson 3: Stay Community Focused

Despite JPM’s enormous size (currently $4.1T in assets and $525B market cap), Jamie Dimon emphasizes in multiple ways that the Bank’s focus is on the communities in which it operates. The Bank aims to be a responsible citizen at the local level in every community where it lends and takes deposits. While some Americans have lost trust in the ability of large institutions like the federal government, national media, and big banks to understand or care about their needs, JPM’s consumer and community bank division uses local branches to meet the needs of its respective community.

Jamie Dimon states that bankers are champions of the community they serve, and have the potential to bring people together, enable companies and individuals to attain their goals, and for being a source of strength in difficult times. JPM believes that it holds 9.5% of the nation’s business banking within its consumer and community banking division (this division serves small businesses and individuals).

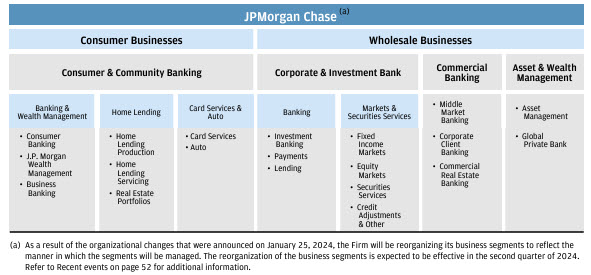

Interestingly, JPM reorganized at the start of this year placing more emphasis on wealth, payments and community banking (below).

Lesson 4: Importance of Technology and Artificial Intelligence (AI)

After being scared of gen AI and blocking all employees from it, Jamie Dimon has embraced the new frontier. JPM was ranked #1 for AI capabilities on the Evident AI Index. JPM as an organization, and Jamie as the CEO, are convinced that AI will have an extraordinary impact on business, and possibly a transformational impact. Jamie compares the impact of AI to the printing press, the steam engine, electricity, computing, and the internet. JPM now employs 2,000 AI and machine learning (ML) experts and data scientists. AI and ML is being utilized in marketing, fraud and risk, and increasingly in software engineering, customer service, as well as employee productivity. JPM created the position of Chief Data & Analytics Officer that sits on the bank’s operating committee and reports directly to the CEO.

Lesson 5: First Republic Purchase – Managing Interest Rate Risk in M&A

Jamie DImon states that regulators relied on JPM to step forward and purchase the failing bank. This helped stabilize and strengthen the US financial system. In the process of the purchase, JPM recorded an accounting gain of $3B, and expects to add $2Bn to earnings annually. What we find most interesting in this section is transcribed below:

Fortunately, we were very familiar and comfortable with all of the assets we were acquiring from First Republic. What we didn’t take on was First Republic’s excessive interest rate exposure – one of the reasons it failed – which we effectively hedged within days of the acquisition. [emphasis added]

Lesson 6: Commercial Banking Profit Drivers

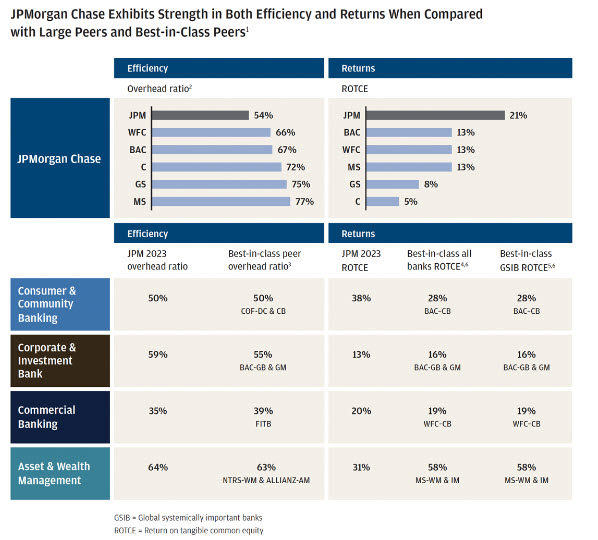

Total 2023 bank revenue was $159B, and loans outstanding was $1.3T. Much of the JPM’s business lines do not compete with the community bank’s business model, however, JPM’s Consumer & Community Banking division serves 82 million US consumers and 6.4 million small businesses – and this division competes squarely with community banks.

This division demonstrated a 50% efficiency ratio, and 38% ROE (top divisional performance within JPM). Of note is that of the $70B in revenue in this division, $15B (or 21%) was noninterest revenue. Noninterest income is a large driver of profitability for JPM and is a substantial driver of the 38% ROE for this division. The other major driver of profitability is the 50% efficiency ratio. We believe that the bank’s stated emphasis on larger relationships (but still small business), the longer expected lifetime of the relationship and its emphasis on profitable products such as long-term loans and payments drive this low efficiency ratio plus profitability.

Lesson 7: Real Estate Focus – Quality Matters

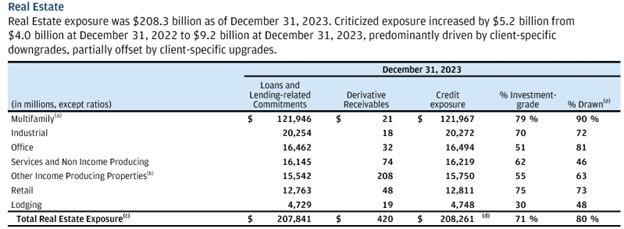

The bank’s real estate comprises the largest percentage of loans at the bank (at $208Bn or about 16% of total loans). The industry exposures in real estate are shown in the table below.

The bank holds the #1 market share for multifamily lending. The key takeaways in the data above are the high percentage of investment-grade credits (at 71%) and the high percentage of loans drawn (at 80%).

Lesson 8: America’s Global Leadership Role

This is not banking-related, but it is our favorite part of the Jamie Dimon letter. He connects the power and strength of the American experiment with the need for America to accept its global obligation as the leader of the free world. There are no other democratic countries as alternatives to the U.S. to counterbalance autocracies and invaders of free and democratic countries. Jamie writes that “America remains the bastion of freedom and the arsenal of democracy.” There simply is no good alternative to America, and most of the world wants America to lead.

The complete letter can be found HERE.