Soggy 7Y Auction Prices On The Screws; Foreign Demand Sags Amid Surge In Directs

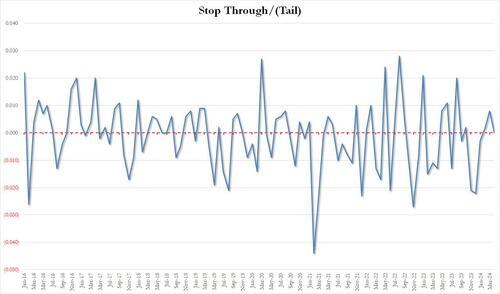

Following two solid, record-large coupon auctions this week, when first the 2Y auction stopped through and then the 5Y auction tailed, we just got the third possible outcome moments ago, when in the sale of $44 billion in 7Y paper (which was not a record large auction unlike the week's previous two offerings), the high yield stopped at 4.716%, right on top of the When Issued 4.716%, or "on the screws" in the parlance of our bond times. That means that for 3 consecutive auctions we have not seen a tailing 7Y auction, with the last tail observed during the January sale (when the offering tailed by 0.3bps).

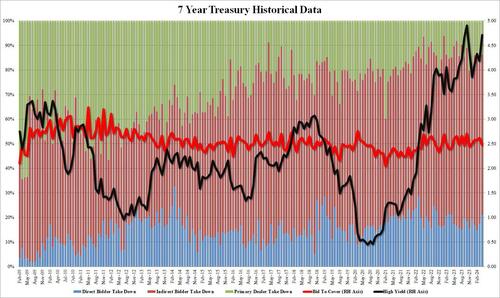

That said, the auction yield jumped a whopping 53bps from March, and was the second highest ever.

The bid to cover took a step back, dropping from 2.614 to 2.481, the lowest since November, and below the recent auction average of 2.56.

The internals were soggy too, with Indirects awarded 65.1%, down from 69.7%, the lowest since December, and below the recent auction average of 67.8%. But thanks to Directs surging to 21.0%, up from 17.4% and the highest since April 2023, Dealers were left holding just 13.9%, below the six-auction average of 15.1%

Yet despite some internal weakness, the auction was generally well received which is why the market barely moved on news of the auction, with the 10Y essentially unchanged after it.